Consignors bullish on another strong Harrisburg sale

Coming off the highest-grossing yearling sale in the Standardbred Horse Sales Company’s 84 years, more strong numbers are expected when horses begin selling on Monday at the Pennsylvania Farm Show Complex.

by Dave Briggs

In 2022, the Standardbred Horse Sales Company sale set an all-time record for yearling sale gross that surpassed the previous record by nearly $1.6 million despite selling 144 fewer horses than the previous record year (2007).

Consignors said there’s no reason to expect this year’s yearling sale won’t be as strong or stronger — especially since the Lexington Selected Yearling Sale set both a record for gross ($67,916,300) and number of yearlings sold for $100,000 or more (233).

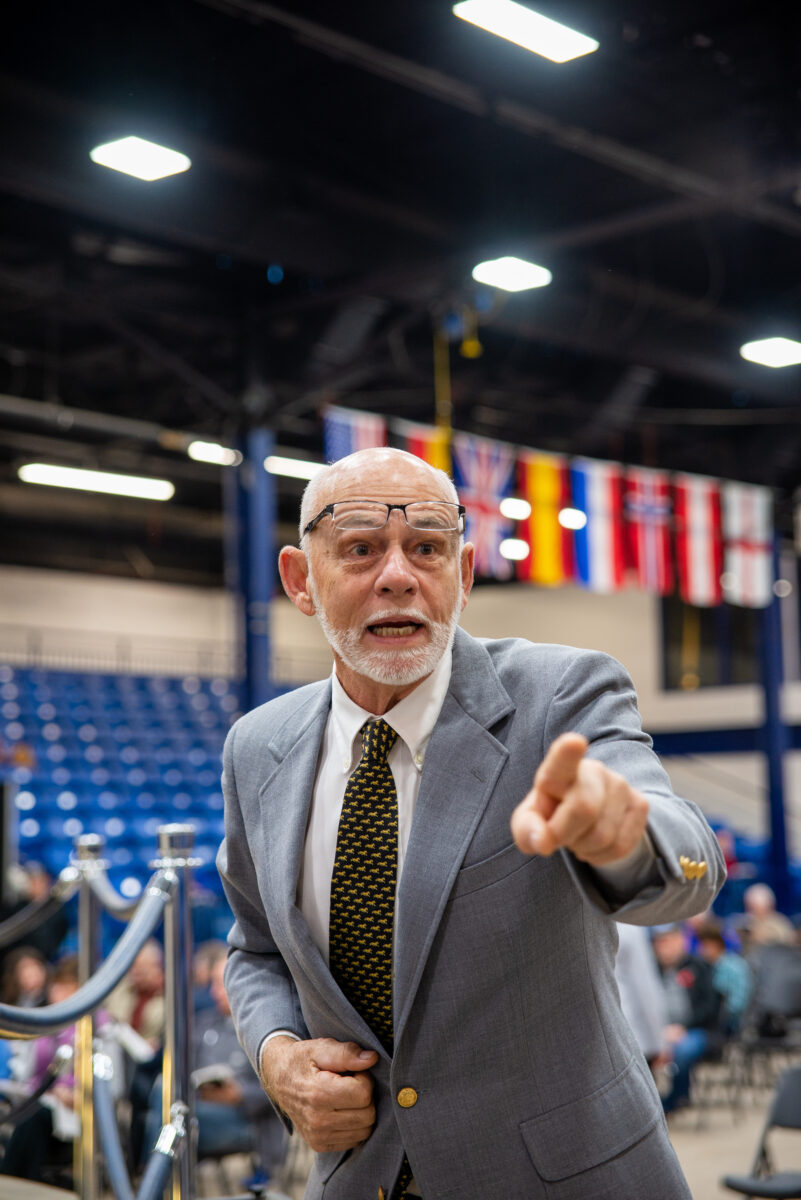

“We always seem to have a pretty sequential carryover [from Lexington] as far as the market goes, as far as the interest goes and undoubtedly, we’ll have some very, very nice horses at Harrisburg,” Dr. Richard Meirs, president and general manager of Walnridge Farm told HRU’s Debbie Little. “So, I feel quite strongly that the money will come and the good clients will come, the interest will be there. And, generally when one strong sale occurs in Kentucky, that sequentially comes up to Harrisburg.”

This year, the SHSC auction will celebrate its ruby anniversary honoring its 85th year in business. The sale begins Monday (Nov. 6) and runs through Friday (Nov. 10) at the Pennsylvania Farm Show Complex (PFSC) in Harrisburg, PA. The first three days are devoted to selling yearlings. The last two days are reserved for the mixed sale.

In 2022, 904 yearlings sold over the three days. The Harrisburg yearlings grossed $44,366,000 to crush the previous record of $42,784,000 set in 2007 when 1,048 horses sold. The 2022 gross also represented a 4.5 per cent increase over last year’s gross of $42,465,500 from 777 yearlings sold in the three days.

Last year’s average of $49,109 was second best in SHSC yearling sale history behind only the average of $54,653 reached in 2021 when 131 fewer yearlings were sold.

“I can’t thank the consignors, buyers and breeders enough,” said Dale Welk, president/director of operations for the SHSC at the conclusion of last year’s yearling sale. “We’re down in average, but I think at times there’s a little too much emphasis put on the averages at every sale… If there are happy people – happy consignors and happy buyers – that’s all that matters.”

Shaun Laungani, Diamond Creek’s vice-president and director of bloodstock services, told Debbie Little that he expects this year’s SHSC yearling sale to be exceptional.

“I’ve been at fault in the past thinking that as Lexington’s gotten kind of stronger the last couple of years, that, well, Harrisburg has to suffer because there’s only so much money to go around, but I’ve been wrong in the past on that,” Laungani said. “What I’ve seen, especially the last two years, where Lexington’s been strong it’s just spilled right over. And I think we all, or most people, tend to be nervous and anxious leading into any horse sale for good reason, you know, you never know till, you know.

“But I’m usually on the other side, I’m usually very optimistic and, yeah, there’s a lot of conflict going on in the world, but we’ve all chosen this lifestyle with horses probably because we like to tune some of that out. We’re not in a fantasy world by any means, but our [harness racing] world is very exciting and positive compared maybe to the overall economy or overall world state of affairs. So, yeah, I think it’s going to be gangbusters again, just like Lexington and it will spill over.”

Preferred Equine’s David Reid said he prefers not to be overly optimistic about how horse sales will go.

“I think my only concerns are the same as going into Lexington — inflationary pressures, the current state of the world affairs and current currency conditions,” Reid said. “Those three factors and it’s hard to determine what those three are. I still believe they are contributing factors that will impact any sale, not just this sale, one way or another until a lot of these issues are resolved.

That said, the Lexington sale was stronger than Reid said he anticipated and he has similar hopes for this week’s auction in Harrisburg.

“I was thrilled with the outcome of Lexington and I think if you take a deep dive into it, I think there was some new ownership participation that was part of it,” said Reid, who co-manages the Lexington sale. “The sire diversification and the additional first-crop sires were part of it. I do think currency did play a factor in it. I think maybe from certain other countries from outside of the U.S. were probably less active. I think you can make an argument that maybe, perhaps, horsepeople that are in smaller jurisdictions were maybe impacted as well.”

As for the economy, Blue Chip Farms owner Tom Grossman said, “the financial markets, in my opinion, are extremely resilient. If you just read the news about what’s going on in the world, you’d think there would be much more havoc in the financial markets. I think if anything ever quieted down politically and/or in the Middle East et cetera, I think we’d have a hell of a rally.”

Though, Reid dismissed the notion that yearling buyers in both Harrisburg and Lexington are predominantly spending discretionary money.

“I read those comments at the Lexington sale and I disagree a little bit because it’s not all discretionary income for all buyers,” Reid said. “I think for the upper tier, you could probably say that, but there’s plenty of mom and pops that work very hard, week in and week out, that they like to participate in the sale at a little bit of a lower level and I think [the economy] does impact them.

“I hear what they are saying about the discretionary income, but there’s many people that treat it as a business as well. I expect them to be here and I expect them to be shopping, but they are a bigger part of the industry than they get credit for, I think. It will be interesting to see how they are impacted on inflationary issues.”

Bottom line, said Reid, “Purses are great and [the racing] environment has been consistent. I think people want to buy horses and I think it’ll be a good sale, but going back to my original statement, it’s hard to quantify what those [economic] issues are, but to say they aren’t affecting, I don’t buy that theory.”

Meirs said it’s important to remember, “There’s a lot of good horses that come out of Harrisburg… And the Kentucky numbers sometimes are a little bit inflated… The Harrisburg numbers are a little bit of a better reflection on what actually the horses are worth and what they bring.”